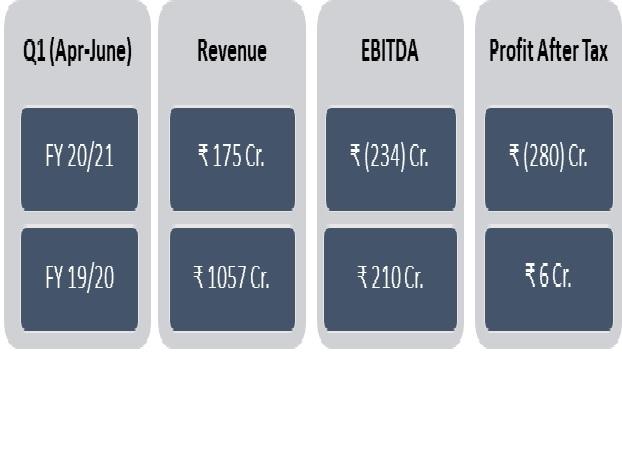

COVID Impact: IHCL Registers Q1 Net Loss of Rs 280 cr

Representative image

Representative image

Indian Hotels Company (IHCL) reported net loss of Rs 280 crore in the first quarter ended June 30 compared to a net profit of Rs 74 core in Q4 FY20 and profit of Rs 6 crore in the year ago quarter. The company’s reported revenue was Rs 175 crore down from Rs 1101 crore in the previous quarter and Rs 1057 crore in the year ago quarter.

“The global travel and tourism industry was at a virtual standstill in the last three months, which had a big impact on the hospitality sector. While over 50% of IHCL hotels were closed for most part of Q1 due to government lockdowns, we implemented R.E.S.E.T 2020, a strategy to mitigate the impact of COVID-19; and several revenue enhancement and spend optimization measures initiated have started yielding results. We remain confident, given the strength and power of our brand and our market leadership, that we will weather this disruption and emerge stronger,” Puneet Chhatwal, MD and Chief Executive Officer, IHCL, said.

R.E.S.E.T 2020, a comprehensive five-point strategy, provides a transformative framework to help the Company overcome the COVID-19 related challenges and achieve revenue growth while optimizing expenditure and strengthening balance sheet and at the same time, continuing on its path of excellence.

• Revenue Growth – Implemented a host of new revenue generation initiatives such as Hospitality@Home, Qmin and rolled out various campaign offers like 4D – Dream, Drive, Discover and Delight, Urban Getaways and Bizcation to stimulate and capture domestic demand

• Excellence – Enhanced SOP’s under Tajness – A Commitment Restrengthened and I-ZEST: IHCL’s Zero-Touch Service Transformation, which ensures heightened safety for guests and employees through a host of digital and service interventions

• Spend Optimization – Leveraged opportunities across all cost heads to rationalize resources and optimize expenditure

• Effective Asset Management – Continuing to undertake renegotiation of contracts and lease rentals, while monetizing assets

• Thrift and Financial Prudence – Taking necessary steps to ensure adequate cash flows while reducing the corporate overheads of the company

Giridhar Sanjeevi, Executive Vice President and Chief Financial Officer, IHCL, said, “We have taken substantial steps to preserve liquidity. In addition, we are rationalizing all costs and maintaining the highest financial prudence. This will assist us in managing the evolving situation.”